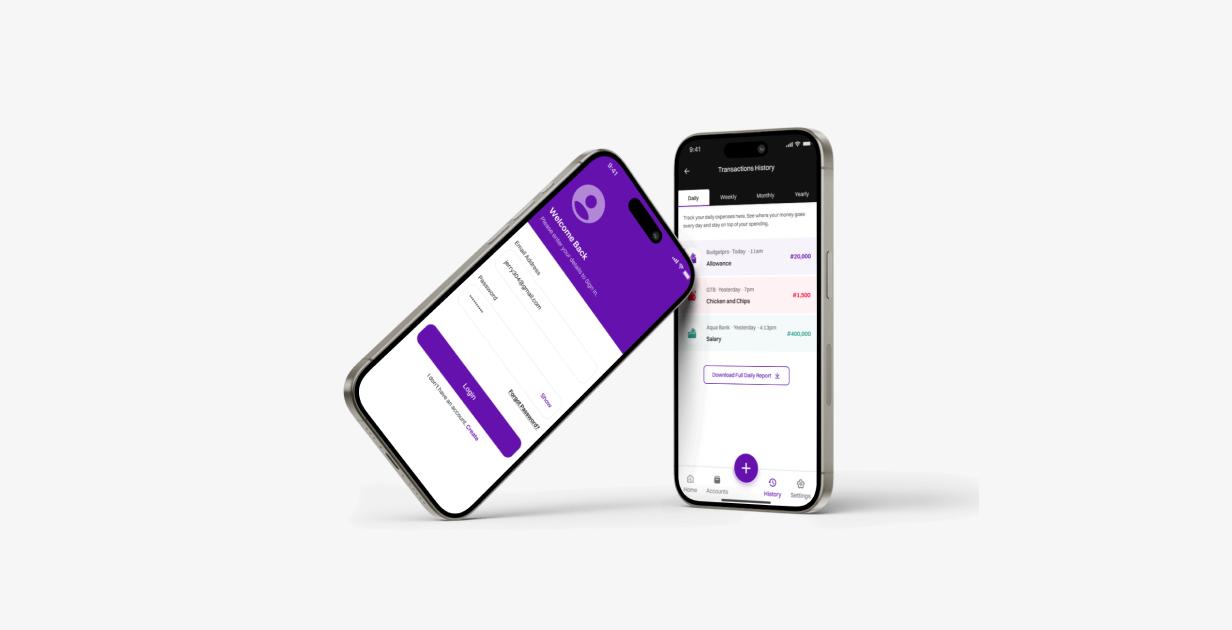

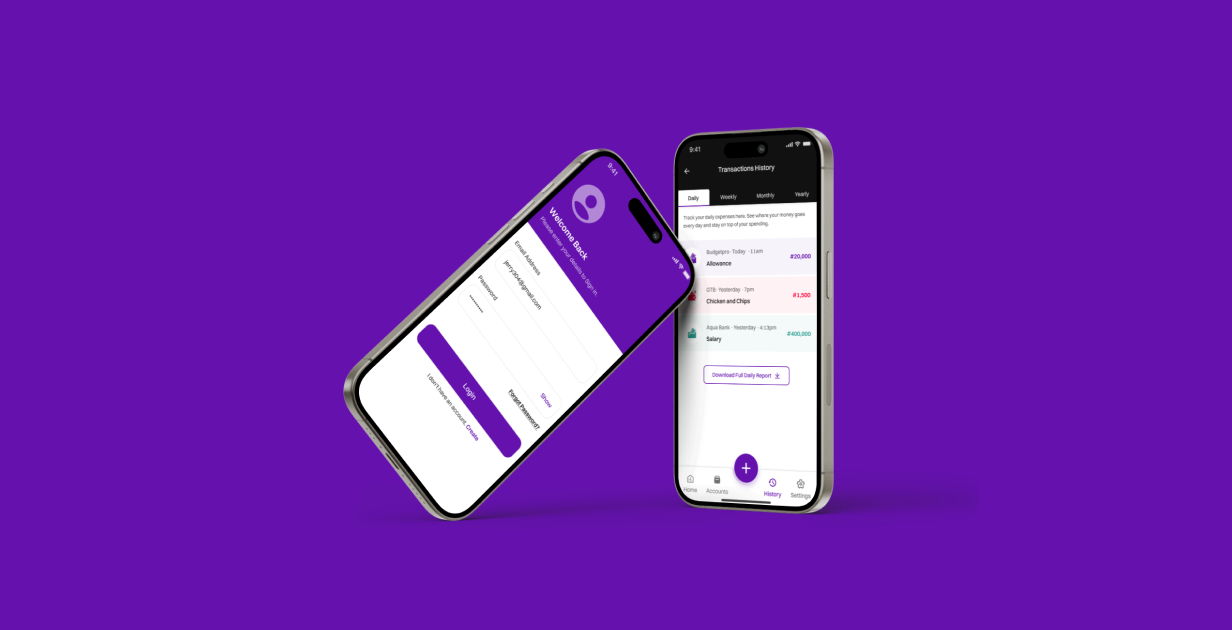

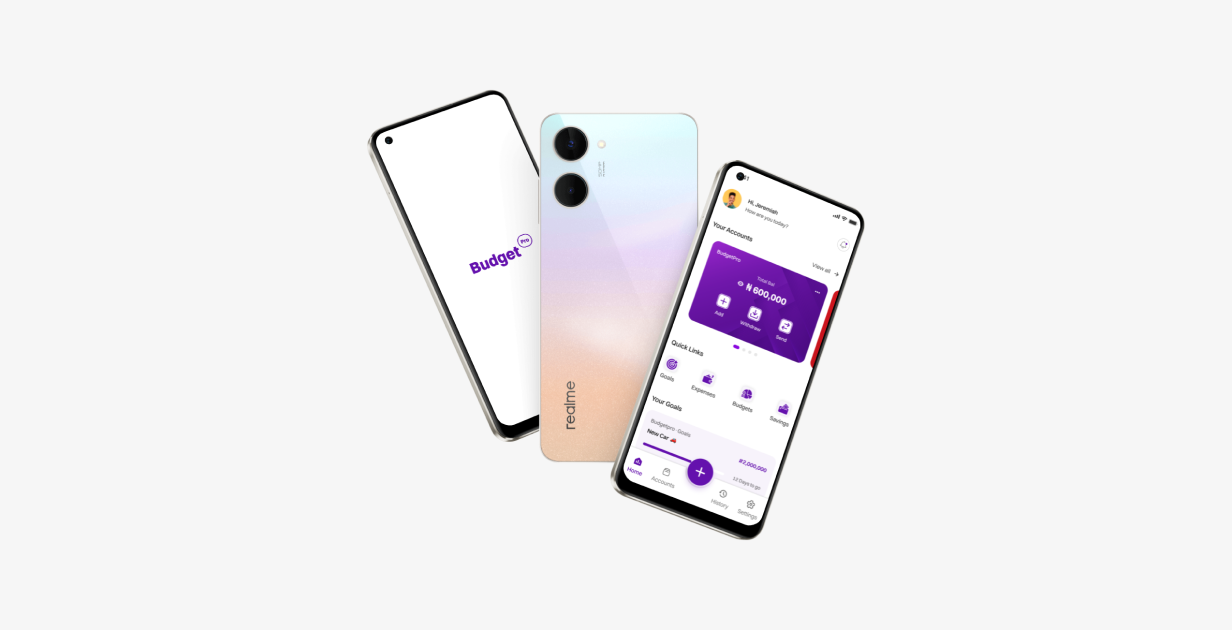

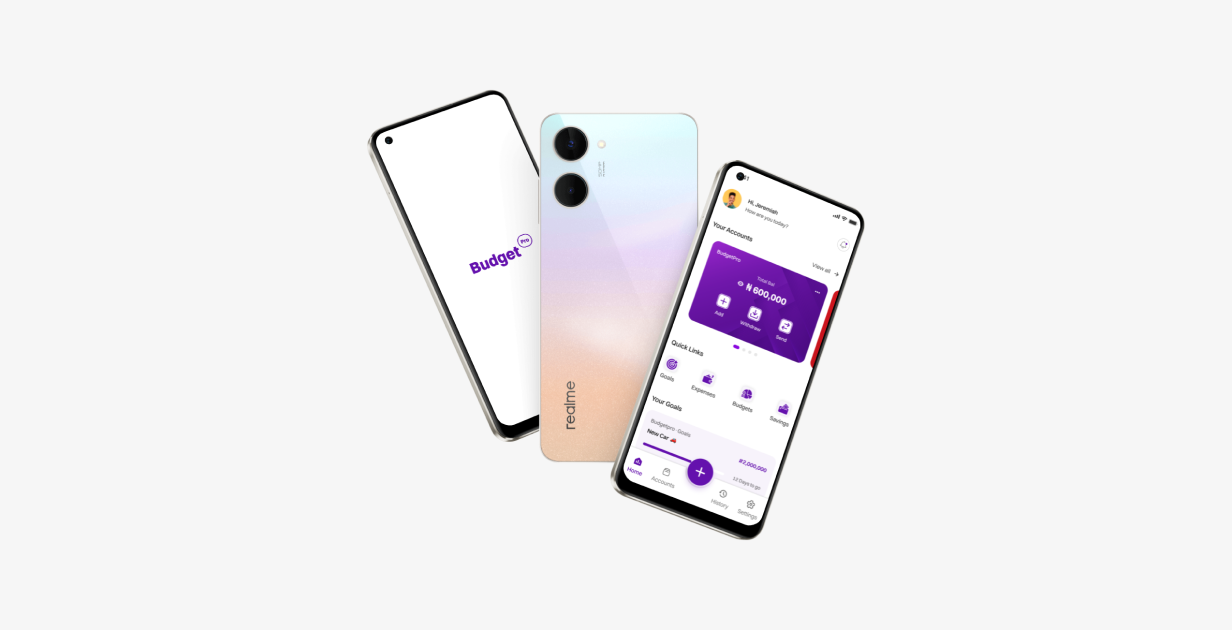

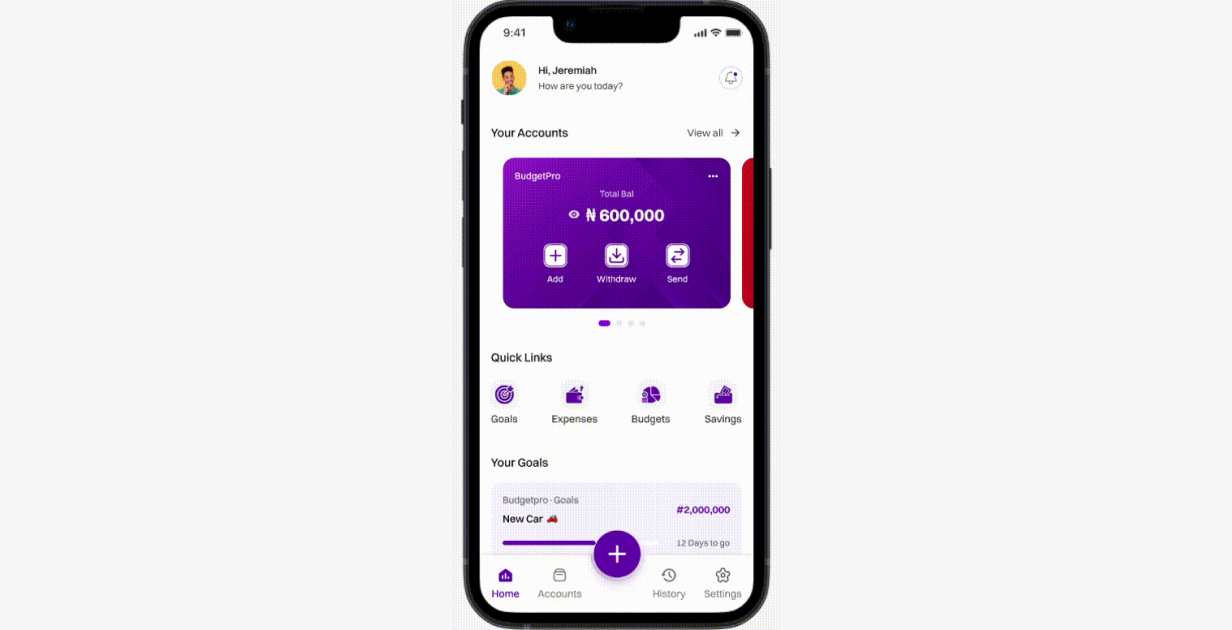

BudgetPro is a fintech app designed to provide users with an intuitive platform for managing personal finances. It offers features like linking multiple bank accounts, expense tracking, budget creation, and financial analytics. With a user-friendly interface, BudgetPro empowers users to make informed financial decisions.

2 Months

Figma

Users often face challenges in effectively managing their personal finances, including difficulties in tracking expenses, setting realistic budgets, and gaining a comprehensive overview of their financial situation.

Develop a user-friendly budgeting app for tracking expenses and income.

Create a platform for users to link all their bank accounts

Enable users to set financial goals and monitor progress

Ensure data security and privacy

The app is tailored for individuals seeking a simplified and effective way to manage their personal finances, regardless of their level of financial expertise.

My design process for the BudgetPro project follows a systematic and user-centric approach to create an intuitive and efficient fintech app. It consists of five essential stages:

User Surveys

Competitive Analysis

User Personas

App Map

Low Fidelity Designs

High Fidelity Designs

Prototyping

Review

User Testing

Feedback

I began the project by conducting extensive research to understand the financial management needs of our target users. This involved user surveys, competitor analysis, and market trends. Gathering insights from potential users helped me identify pain points and opportunities.

To gain deep insights into the financial management needs of our target users, I designed and conducted comprehensive user surveys. These surveys were strategically crafted to collect valuable information about users' budgeting app experiences, financial habits, pain points, and preferences. By analyzing survey responses, I could identify user requirements and expectations.

None. Problem's from my end

The urge to spend that money

None so far

Reminders/alerts

Not meeting the set goal

I can't withdraw if it is connected to two debit card

Lack of budget interface

Nothing really.

The survey data unveiled diverse usage patterns, ranging from sporadic to non-existent engagement with budgeting apps among participants. This insight steers the project towards a user-centered methodology, emphasizing the importance of tailoring the design to accommodate the distinct needs and behaviors of users. This user-focused approach ensures that BudgetPro aligns closely with the preferences and expectations of its diverse user base, fostering a more inclusive and effective personal finance management experience.

In the ideation stage, I created the personas and app map for BudgetPro. This involved envisioning the app's structure and understanding users' needs, pain points, and motivations. The goal wass to ensure an intuitive design aligned with user requirements

Name: Adaobi Chukwuemeka

Age: 28

Occupation: Marketing Executive

Income: ₦150,000 monthly

Adaobi is a young working professional who is constantly on the go. She needs a budgeting app that is easy to use and helps her track her expenses on the go. She wants a feature that can link her accounts to automatically import transactions so that she doesn't have to manually input them.

- Difficulty in tracking her expenses

- Not having enough money left over at the end of the month.

- Saving up for a down payment on a house

- Having a better work-life balance

Name: Emeka Obi

Age: 35

Occupation: Business Owner

Income: ₦500,000 monthly

Emeka is a successful entrepreneur who wants to keep track of his finances and investments. He wants a budgeting app that can help him track his expenses, investments, and net worth all in one place. He is willing to pay for a premium app that provides additional features like tax tracking and investment portfolio tracking.

- Difficulty in tracking investments and net worth

- Not being able to plan for taxes effectively.

- Apps that do not provide a comprehensive view of his finances

- Lack of advanced features in free apps

- Building wealth.

- Achieving financial independence

Name: Funke Adekunle

Age: 23

Occupation: Student

Income: ₦30,000 monthly (allowance from parents)

Funke is a student who wants to learn how to budget her money effectively. She wants a budgeting app that is simple to use and can help her track her expenses so that she can better manage her allowance. She is looking for a feature that can help her set financial goals and track her progress towards achieving them.

- Not having enough money to do everything she wants

- Difficulty in tracking expenses.

- Budgeting apps that are too complicated to use.

- Lack of motivation to stick to a budget.

- Saving up for a study abroad program

- Being able to buy nicer things.

Name: Tunde Williams

Age: 45

Occupation: Civil Servant

Income: ₦100,000

Tunde is a civil servant who wants to get his finances in order. He wants a budgeting app that can help him track his expenses and set financial goals for himself. He is looking for an app that is easy to use and doesn't require too much input from him. He wants to be able to see his progress towards his financial goals and receive reminders to stay on track.

- Difficulty in tracking expenses.

- Not being able to save enough money.

- Budgeting apps that are too complicated to use.

- Not being able to see his progress towards his goals.

- Paying off debt.

- Saving up for his children's education.

In this stage, I translated my ideas into tangible forms through sketches, low-fi wireframes, and high-fi designs for BudgetPro. The aim of this process was to visually communicate the app's layout, features, and aesthetics, ensuring alignment with user-centric principles.

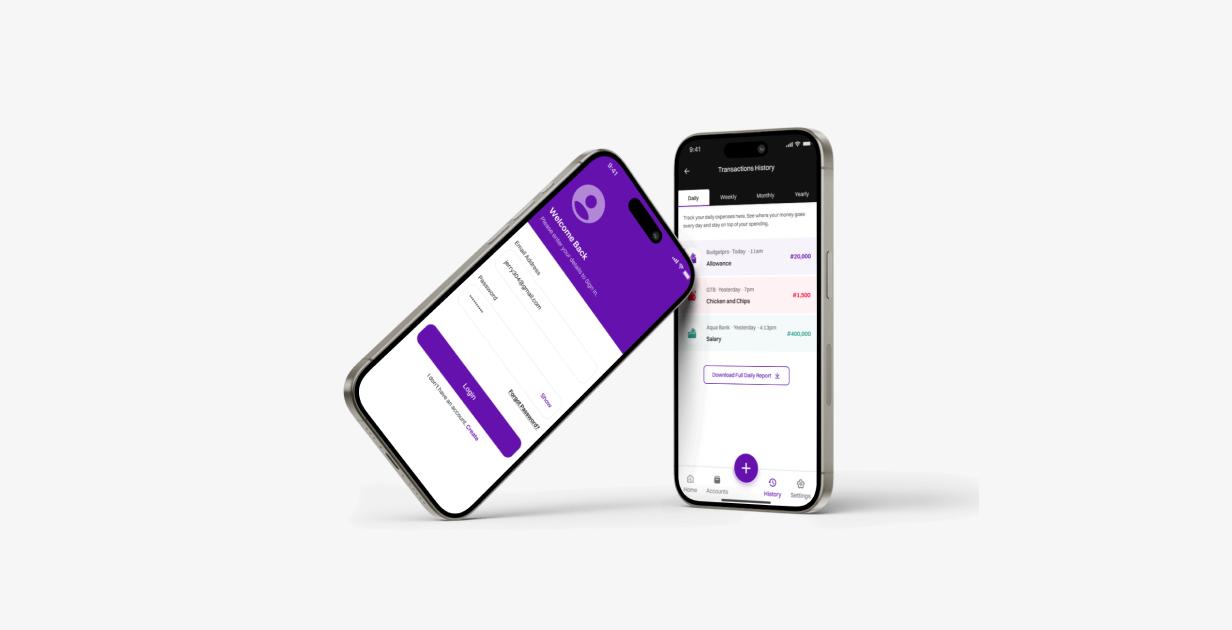

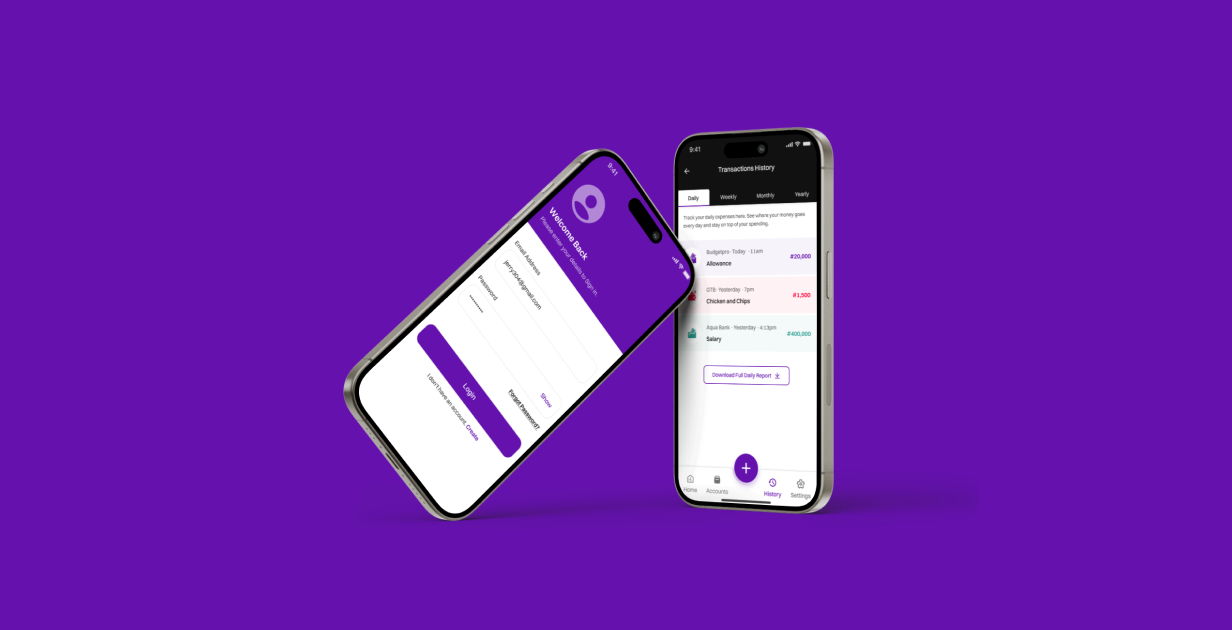

In the prototyping stage, I brought BudgetPro to life by showcasing key processes such as sign-up, homepage navigation, goal creation, account linking, and budget creation. These prototypes serve as interactive representations, allowing users to explore the app's functionality before potential development.

The sign-up process offers users a seamless and intuitive journey to create their BudgetPro accounts, emphasizing simplicity and clarity in form inputs.

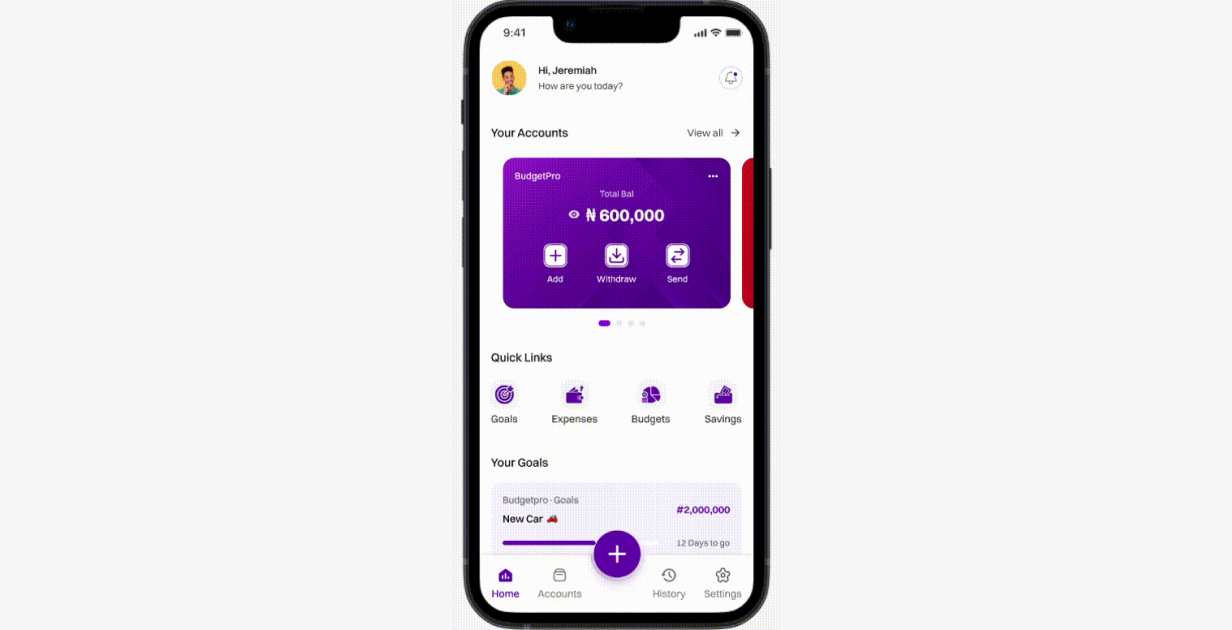

The homepage serves as the central hub, providing users with an at-a-glance overview of their financial landscape. It ensures quick access to essential features, promoting efficient navigation.

This feature empowers users to set financial goals with ease. The process involves defining specific objectives, timeframes, and tracking mechanisms, Locking, ensuring a personalized goal-setting experience.

Users can link multiple bank accounts effortlessly through this process. The intuitive design simplifies the steps, enhancing the user's control over their financial data.

The budget creation process is designed for simplicity, allowing users to allocate funds to various expense categories and track their spending patterns effectively.

During the feedback sessions, users expressed significant interest in the multiple bank feature, highlighting its uniqueness and practicality. Many were pleasantly surprised by the functionality and expressed a desire for similar capabilities in their financial management apps. I shared insights about the feasibility of multiple account linking, and some users were intrigued by the idea, mentioning a specific app, Trakka, that also offered such functionality. This interaction provided valuable feedback on user expectations and helped in further refining BudgetPro's features.

Difficulty in gathering user feedback for the budgeting app.

Designing the app to meet user needs based on collected data.

Overcoming electricity-related delays.

Balancing the design with multiple bank colors.

Leveraged social media to collect user survey response.

Engaged with friends for valuable insights.

Optimized productivity during electricity downtime.

Developed a cohesive design strategy to accommodate various bank colors.

I gained enhanced proficiency in autolayout and component usage better than my previous projects.

I gained expertise in harmonizing diverse color schemes

Continued learning and improvement

You deserve a treat🍔🍕🌭🍟🍹